We are excited to share that our President & CEO, Lloyd Rosenberg, was among the honorees this week at the 2019 ICON Awards presented by NJBiz.

Lloyd is the driving force behind the phenomenal growth and success of DMR Architects, a firm with New Jersey roots, strong relationships with the business community and a passion for advancing the facilities and communities where we live. Lloyd founded the firm in 1991, and continues to lead the firm today as President & CEO.

When Lloyd founded DMR Architects, it was a three-person operation with no office, no staff and no clients. Originally committed to designing exclusively educational facilities, over the years, Lloyd steadily added expert talent and responsibly diversified the firm’s capabilities, resulting in a firm today that employs a staff of 40, consistently ranks among the top architectural firms in the state, provides a diverse range of services and completes an average of 100 projects a year across all market sectors. For its entire history, DMR has called northern New Jersey home, with all employees working from the office’s sole northern New Jersey location and the majority of the firm’s projects being located within the state.

Lloyd was a leading architect who enjoyed a more than 25-year, award-winning career with plenty of professional highlights prior to the founding of DMR. The physical environment of his professional work ranged from projects close to home to around the globe.

Despite a storied career prior to the firm’s founding, Lloyd’s greatest career accomplishments have come during the last 28 years, where he has grown DMR Architects into the team it is today, a thriving professional service firm that employs a uniquely qualified staff; architecturally serves all market sectors; and has also positioned itself as a leader in pioneering redevelopment planning and sophisticated sustainable design services. As part of a strategic and responsible diversification program, today the DMR team also includes professionals with backgrounds in economic development and community outreach, municipal government, real estate, project finance, engineering, and land use, as well as in-house general counsel, positioning the firm as a team that provides unparalleled services to its clients.

Lloyd has played a role in overseeing thousands of design and construction projects while leading DMR, a volume of work that represents hundreds of millions of dollars in construction. Among these projects are many that have had a great impact on the landscape of New Jersey, including the State’s first nature museum; the first school for the blind and the first LEED certified public school; Bergen County’s first brewery; the rail station that first brought train service to the Meadowlands; and the new Frank J. Gargiulo Campus, the $150 million vocational/technical high school in Hudson County, one of the most technologically-advanced schools in the country. The thousands of other projects completed under Lloyd’s direction include sophisticated healthcare facilities, elementary schools, luxury lofts, downtown master plans, police stations, parks, modern offices, academic facilities, sports complexes, renovations to an elementary school forced to close following Superstorm Sandy and construction oversight of the much-anticipated American Dream project.

Lloyd is involved and hands-on, with an everyday presence and involvement in the functions of the firm. He is a supportive leader dedicated to the professional growth of employees, empowering them to take on new responsibilities, expand their capabilities and immerse themselves in the business community, without fear of failure.

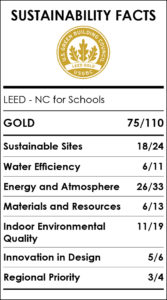

The Frank J. Gargiulo Campus, the new, 350,000 square foot high school that opened its doors in September 2018, has achieved LEED Gold certification.

The Frank J. Gargiulo Campus, the new, 350,000 square foot high school that opened its doors in September 2018, has achieved LEED Gold certification.